When you find yourself buried under a mountain of debt or struggling to manage your finances, seeking help from a credit counselor can be a wise decision. Credit counseling agencies are non-profit organizations dedicated to assisting individuals like you in getting back on track financially. However, not all credit counselors are the same, and it’s […]

Continue ReadingTag: Non-Profit Credit Counseling

The Main Differences Between For-Profit And Non-Profit Credit Counseling

Credit counseling is valuable for individuals seeking assistance managing their debt and improving their financial well-being. Two primary credit counseling services exist, for-profit and non-profit credit counseling, which is provided by Non-Profit 501(c)(3) organizations. Understanding the differences between these two options can help consumers make informed decisions about the type of credit counseling that best […]

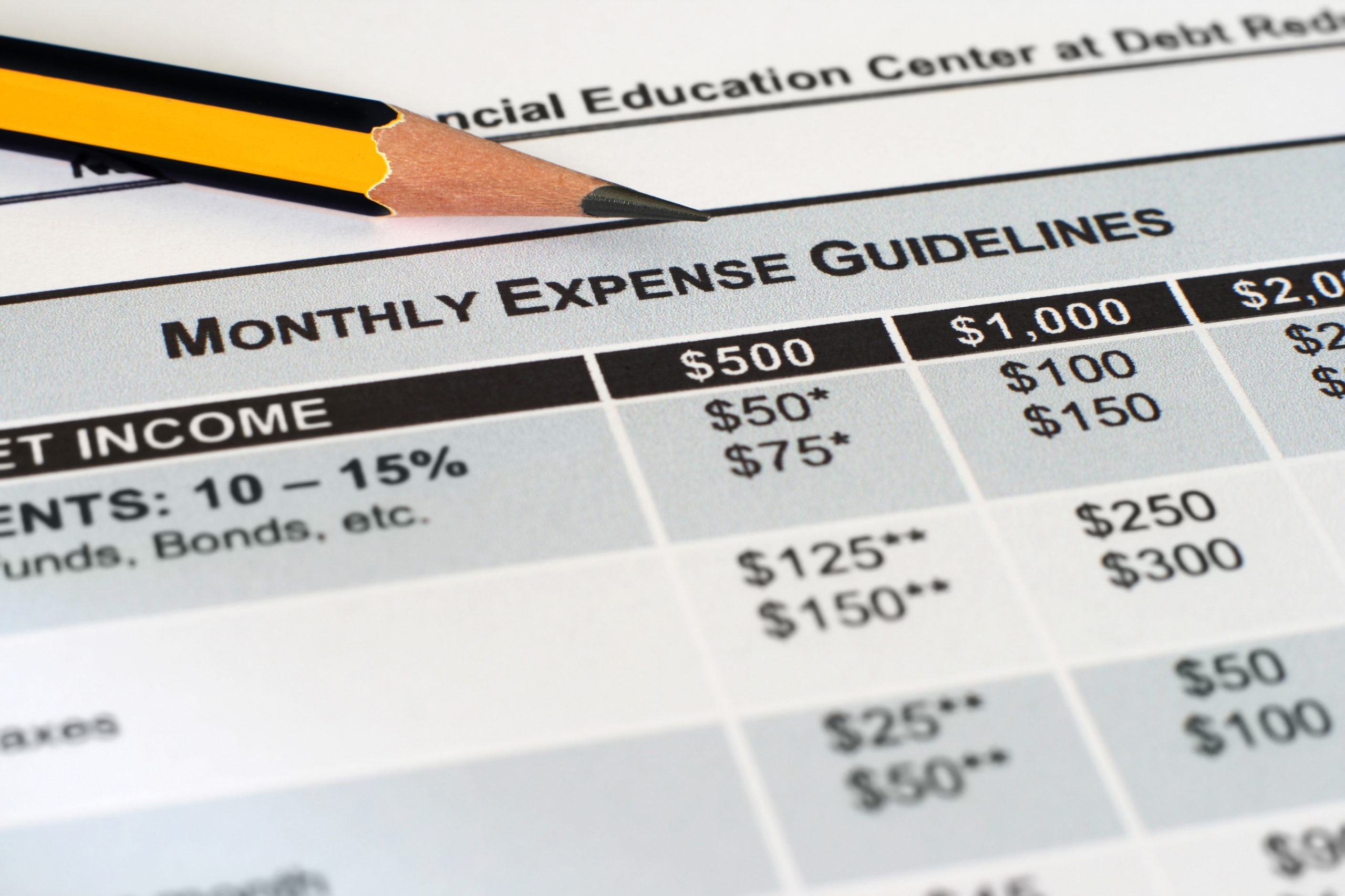

Continue ReadingFind Out How To Reduce Your Monthly Expenses In 2022

As the year wraps up (pun intended), we can look ahead to next year and wonder what our finances might look like in 2022. It’s no secret that inflation is taking off right now, and prices are climbing higher and higher for our everyday needs. So, how does a person reduce their monthly expenses when […]

Continue ReadingHow To Search For The Right Nonprofit Credit Counseling Agency

Taking advantage of credit counseling is one of the best ways to avoid years of high-interest payments on credit cards and other debts. A professionally licensed and accredited nonprofit credit counseling agency can even help you avoid bankruptcy. When used correctly, these services are wonderful alternatives for people who find themselves mired in debt that […]

Continue ReadingThe Value of Credit Counseling in Everyday Life

Credit counseling is often an overlooked free financial tool in our busy everyday lives. We need good credit for everything these days as we transition to less and less cash in our lives. The truth is good credit is not only for financing, but it’s also essential in setting up utilities, getting a cellular phone, […]

Continue ReadingDebt Management Starts With Changing Your Behavior

Do you find yourself deep in debt? Have you enrolled or experimented with any debt settlement programs, but that just left you worse off than before? Are you tired of worrying about money every month? If so, you are not alone. Millions of Americans find themselves in a similar situation every single day. If you […]

Continue ReadingHow to Find Free Debt Management Help

In today’s failing economy, individuals are finding themselves with many bills that they are unable to pay. The amount of debt is far exceeding most individual’s paychecks leaving them with increased difficulty in meeting their financial obligations. Some individuals find themselves searching for free debt management help and others are facing bankruptcy or foreclosure. When […]

Continue ReadingInfographic: If You’re in Debt, You’re Not Alone

Debt is not a pretty word by any means. More often than not, the word itself brings about increased stress, elevated blood pressure, and tension headaches to those who are struggling with debt. The economy has definitely seen better days and more people are turning to credit cards and/or loans to help ease the financial […]

Continue Reading