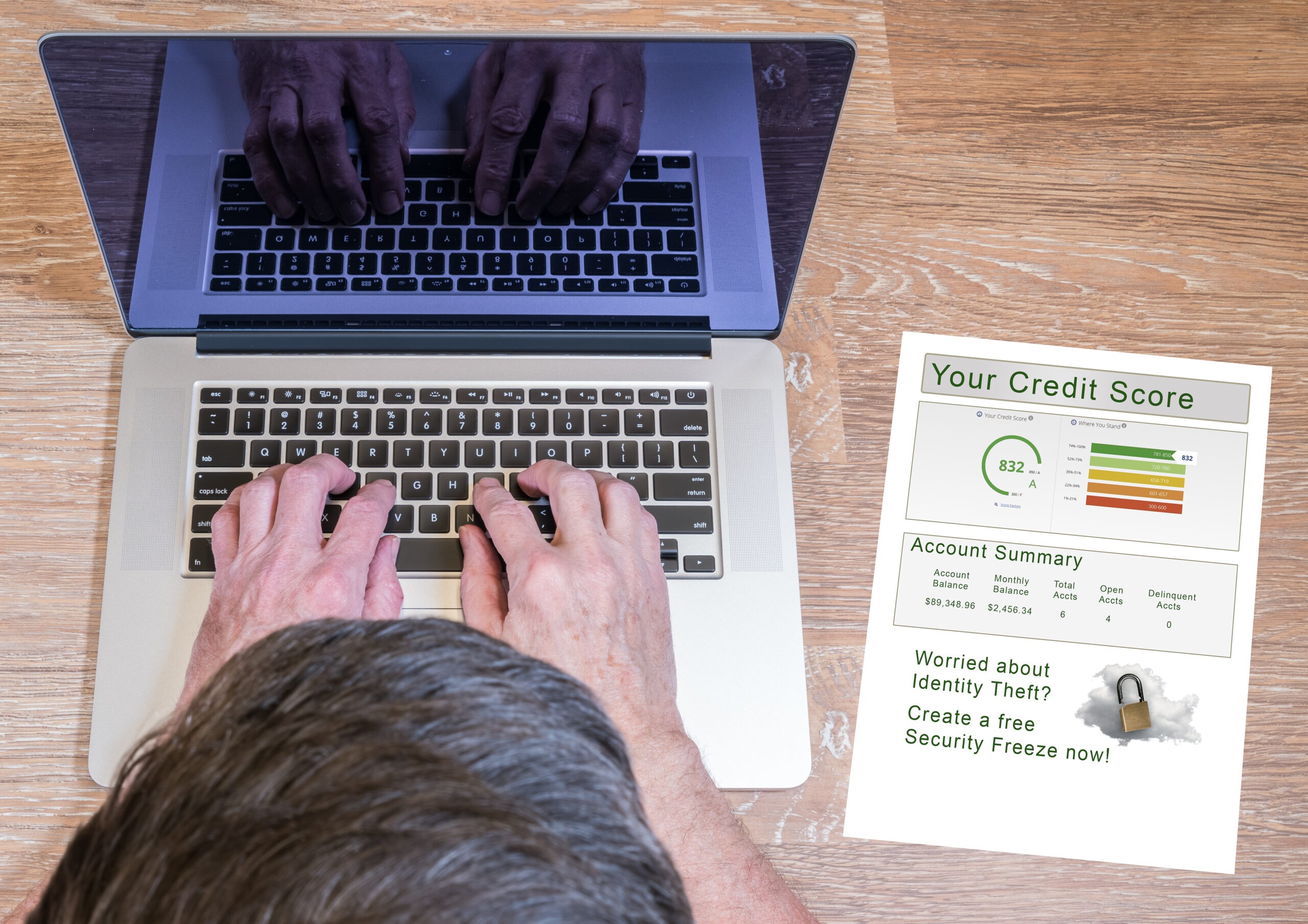

A credit score is a numerical rating that represents a person’s creditworthiness. It measures how likely someone is to repay their debts on time based on their credit history. Credit scores are typically calculated using a mathematical formula that considers various factors, including payment history, the amount of debt owed, length of credit history, types […]

Continue ReadingTag: Credit Counseling

Is Your Emergency Savings Gone And Credit Card Debt Increasing?

Inflation continues to rise, and interest rates are still increasing, so many people are also seeing their savings dwindle and disappear. All of this will undoubtedly lead to their credit card debt increasing as well. Nobody ever wants to be in a position where his or her emergency savings are gone, and their credit card […]

Continue ReadingConsumer Debt Hits Record $16.9 Trillion: Delinquencies On The Rise

This is BIG news, but it’s not the good kind. Household consumer debt in the United States has been steadily increasing over the years and has now hit a record high of $16.9 trillion. This represents a significant burden on American households as many struggle to keep up with mortgage payments, car loans, credit card […]

Continue Reading10 Bad Habits Or Decisions That Can Decrease Your Credit Score

A credit score is a measure of the creditworthiness of a person. The higher the number, the more creditworthy a person is. It’s possible for people to achieve scores in the 800s, which can help them get loans at lower interest rates, qualify for better insurance rates, and make it easier to rent an apartment […]

Continue Reading5 Ways Consumer Credit Counseling Can Help You Manage Your Money Properly

Consumer credit counseling is a service that helps you learn how to manage your money correctly and get back on track financially. This free service allows you to grow as an individual by providing tools and techniques that will enable you to achieve your personal financial goals. Non-profit consumer credit counseling, in particular, helps ensure […]

Continue ReadingThe Best Way To Take Control Of Your Finances This Year

When it comes to managing your finances, it can feel overwhelming if you’re not in control of each dollar that you earn. You may experience stress and avoid tracking your spending, which can make it easy to lose money and get into debt. If you want to learn how to control your finances this year […]

Continue ReadingWhat Are The Most Popular Credit Counseling Questions That Get Asked?

If you’ve been browsing our website, you might have noticed that we offer many tips to help you manage your finances and a lot of great advice about credit counseling and debt management. However, if you’re like many of our potential clients, you probably have questions about the credit counseling process or what happens during […]

Continue ReadingLearn How To Get Your 3 Credit Reports For Free

If you have ever applied for a loan or a credit card, you are probably aware of the importance of your credit report and credit score. The information a credit report contains tells lenders whether you are a “credit risk” or not. It can also determine what interest rates you will be offered and other […]

Continue ReadingThe 5 Quickest Ways To Save Money At The Grocery Store

It’s super easy to overspend at the grocery store. Every week you forget something at home and find yourself scrounging around in a hurry on your break to buy it. There’s a lot of information on the Internet about how to save money on groceries, but it’s not all that different from what you should […]

Continue Reading10 Things To Do After You’ve Paid Off Your Student Loans

Student loan debt has now surpassed credit card debt by over $3 billion. Student loan debt will probably continue to rise quickly unless the government understands its implications on the US economic growth and takes REAL action to mitigate the problem. The graduating class of 2022 is the most indebted in history, with over $56 […]

Continue Reading