Whether you find yourself struggling month to month to pay your bills, fear the looming calls from debt collectors or even worry about potentially losing your home or car, it is important to recognize that there is hope. Thousands of Americans face the financial crisis of seemingly overwhelming debt. With the aid of debt management […]

Continue ReadingTag: Credit Counseling

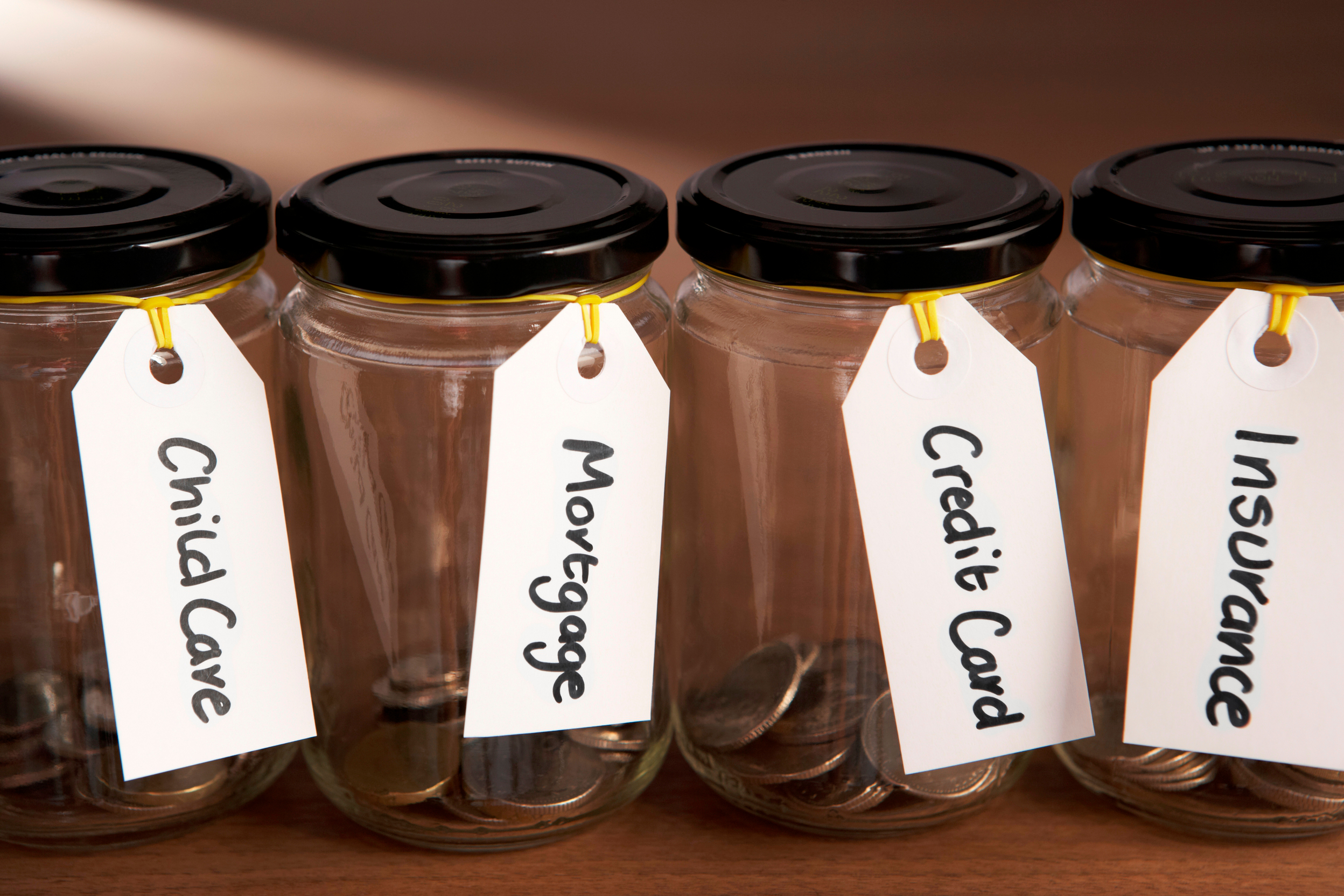

Debt Consolidation Tips

We all know that debt can be overwhelming and even cause problems among family members due to intense stress and many other factors. If you are looking for ways to get out of debt, then chances are you’ve heard about debt consolidation or debt management plans. We’re going to share some debt consolidation tips with […]

Continue ReadingChoosing a Debt and Credit Counseling Service

Have the bills been piling up, and you don’t know where to turn? You need a credit or debt counselor to steer you in the right direction. Most credit counselors with a good reputation are non-profit organizations and offer their services through local branches, online and over the phone, says the Federal Trade Commission. What to […]

Continue ReadingWhat Is A Debt Management Plan?

We get this question a lot from individuals who are battling debt problems. So we figured that we’d give everyone a fairly in-depth and detailed explanation of what a Debt Management Plan (DMP) really is. The Wikipedia definition is very broad and general, but it states: “A debt management plan is a formal agreement between a debtor […]

Continue ReadingCredit Counseling – What Questions to Ask

Credit Counseling can be the answer to many of your financial troubles. Advantage CCS offers stress-free credit counseling to people in need of professional advice, all of which is offered by an experienced and certified credit counseling agency. By analyzing your current financial situation, a certified credit counselor will be able to recommend a plan […]

Continue ReadingHow is interest calculated on credit card bills?

The interest calculated on credit cards can be troubling and confusing. Using a credit card wisely will save you money and keep you out of debt. Carrying balances over each month will lead to a larger balance, with you paying more than the original amount owed. This is due to the credit card interest calculated […]

Continue ReadingWhat Happens When You Contact A Non-Profit Credit Counseling Agency?

Let’s just start by saying that when you contact a non-profit credit counseling agency, that call or visit is absolutely free and completely confidential. A reputable credit counseling agency will never charge for their consultation and advice. If you have to pay an upfront fee for a credit counseling session, don’t trust that company and […]

Continue ReadingWhite Paper: What a Certified Credit Counseling Agency Can Do For You

Even though certified credit counseling agencies can save debt-burdened individuals thousands of dollars and prevent years of financial stress, their services are underused by those who could benefit from them the most. In this white paper, find out the different ways that certified credit counseling agencies can help you and your family, whether you are […]

Continue ReadingNew Hampshire residents have a new choice in debt relief

Advantage Credit Counseling Service has recently been licensed and approved to provide their expert free credit counseling and debt management program to consumers that live in the state of New Hampshire. Now that the Agency is licensed in NH, they only have 4 more states to go before they are licensed in all 50 states […]

Continue ReadingRhode Island credit counseling through Advantage CCS

Advantage CCS is now able to service consumers who live in Rhode Island with free credit counseling and offer, if applicable, a Debt Management Program. Rhode Island residents now have a wonderful new option for debt relief and consumer credit counseling. A Little History about Rhode Island – Rhode Island is part of the New […]

Continue Reading