We get asked this question a lot by our current clients and potential clients: “What is the best debt to credit ratio?” First, we must explain what a debt to credit ratio is. To put it in layman’s terms, it is how much you owe versus your total available credit limit. A debt to credit […]

Continue ReadingTag: credit card debt

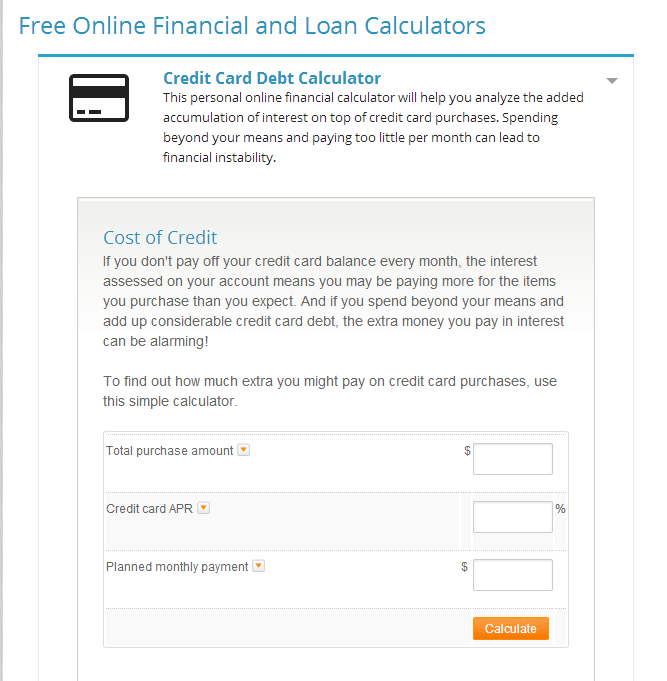

Credit Card Debt Calculator and How to Pay Off Debt

You can always count on interest accumulating if you carry a balance every month on your credit cards. Sure, you may still have a month or two of “free interest” left on that credit card you signed up for, but when that promotion ends, what happens then? You get hit with some charges and fees […]

Continue ReadingWhat is a “charge-off” and how does it affect me?

Credit cards are excellent tools for us to use when we are in a bind, they will usually provide us with funds to keep us going until things get better. However, what happens when things do not get better and there appears to be no light at the end of the tunnel, will we have […]

Continue ReadingWhat Happens if I STOP Paying my Credit Card Debt?

Deciding to stop paying on your credit card debt sets a whole chain of unpleasant events in motion. Over time, the damage that results will haunt the consumer for a number of years. Before entertaining the notion of letting the payments on one or more cards slide, consider what the outcome could be. Penalties and Higher […]

Continue ReadingWhite Paper: What a Certified Credit Counseling Agency Can Do For You

Even though certified credit counseling agencies can save debt-burdened individuals thousands of dollars and prevent years of financial stress, their services are underused by those who could benefit from them the most. In this white paper, find out the different ways that certified credit counseling agencies can help you and your family, whether you are […]

Continue ReadingInfographic: Causes of Debt

When people think of debt, they most often think of credit card debt. However, a significant amount of people’s financial worries actually come from some slightly more unexpected causes of debt. Currently, some of the largest contributors to debt are medical bills, divorce fees and settlements, and student loans. There are other known causes of […]

Continue ReadingHow Much is Your Debt Really Costing You?

We have a guest blog post for you from Katie Bryan over at America Saves. We partner with America Saves, because they are a national campaign linking more than 1,000 Non-Profit, government, and corporate groups that encourages consumers to save money and build personal wealth. We stand behind their message and mission. We are always […]

Continue ReadingInfographic: 2013 Debt Statistics for US Consumers

Over the past decade or so, debt has been a growing problem for families all across the country. While American consumers collectively owe almost $850 billion in unsecured credit card debt, the average American household credit card debt stands at over $15,000 per family. Other types of debt, including secured debt such as mortgages and […]

Continue Reading