You might think budgeting is a straightforward process, but it’s pretty difficult for many people. Keeping track of expenses can be challenging if you have irregular income or don’t usually have access to the same type of money at the same time each month. Some people find it challenging to track their spending because they […]

Continue ReadingTag: budget

Fun Summer Activities On A Budget For The Whole Family

When the weather starts to heat up, and more people head outside, that’s when budgets start to go downhill. While all family members look forward to summer, parents and children typically have different viewpoints on what constitutes as a “fun” summer activity. Of course, when the cost is a factor, trips to the super expensive […]

Continue ReadingOur Online Budget Advisor Tool Is Free & Simple To Use

The Online Budget Advisor tool sets itself apart from the competition by putting over 54 years of expert financial experience behind our system. Our tool is easy to understand, super-efficient, and extremely thorough. The system asks the very same questions that our professional budgeting experts and certified credit counselors ask during their face-to-face or telephone counseling sessions. […]

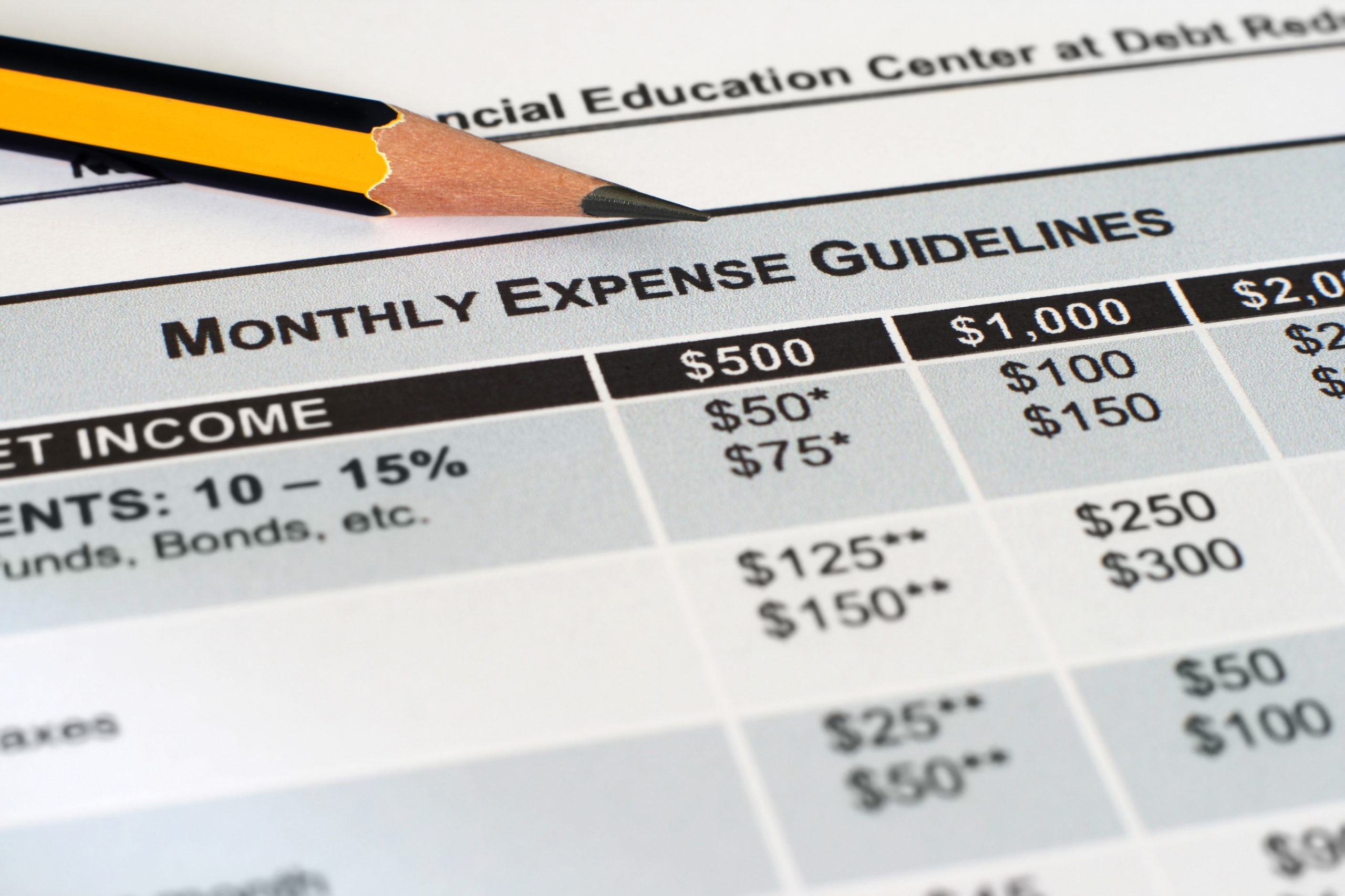

Continue ReadingFind Out How To Reduce Your Monthly Expenses In 2022

As the year wraps up (pun intended), we can look ahead to next year and wonder what our finances might look like in 2022. It’s no secret that inflation is taking off right now, and prices are climbing higher and higher for our everyday needs. So, how does a person reduce their monthly expenses when […]

Continue ReadingFantastic Tips On How To Stop Living Paycheck To Paycheck

More than ever, individuals and families are experiencing economic hardship. Not only is this due to the Covid-19 pandemic but also the loss of federal assistance programs. Approximately 54% of all Americans are living paycheck to paycheck. Some feel there is no way to stop this endless cycle. However, making several smart changes helps families […]

Continue ReadingThe Ultimate Beginner’s Guide To Budgeting And Saving

Most people encounter financial challenges at some point in life; some challenges are more easily resolved than others are. When a person’s primary goals are saving money, budgeting to help make ends meet, and to avoid a financial crisis, there are several helpful tips to keep in mind. How to create a basic budget plan […]

Continue ReadingThe Pros And Cons Of Having A Joint Bank Account

It is common and natural to have a joint bank account with your partner. Although this might signify trust in your relationship and partner, it’s important to understand all aspects. Ensure the decision you have made is right for you and your partner. Even if this sounds and looks great, it’s essential to narrow down […]

Continue ReadingA Budget Will Prepare You For The New Year

No doubt 2020 brought some hardship on everybody, but especially on those who may have been living paycheck to paycheck leading up to it. Some may have always been prepared for events like flooding and hurricanes, but an event like COVID-19 has proven to be something you really can’t fully prepare for given how completely […]

Continue ReadingHow To Avoid Debt Traps This Holiday Season

The Holiday season is knocking on the doors, and indeed, people cannot stop thinking of how much they will spend on gifts and fun activities. Like with other holidays witnessed in recent years, this Christmas season will be a shopping and spending spree for many. However, the shopping frenzy has both benefits and a few […]

Continue ReadingTop 9 Awesome Tips For A Safe Money-Saving Halloween

This Halloween may look a lot different than those in the past. We can thank the Coronavirus pandemic for that. It doesn’t mean you can’t still have a safe and fun time. We’ve got a list of ways you can still be safe and even save money on this ghoulish day. Check them out below! […]

Continue Reading