The 2018 PricewaterhouseCoopers (PwC) Employee Financial Wellness Survey found that 54% of employees are stressed about their finances. According to a Country Financial Security Index survey, 67% of Americans worry about their financial future, credit card debt last year hit a record high, and 44% of people can’t come up with $450 to cover an unexpected expense.

All this financial stress can cause poor work performance, more sick days being taken, and overall low employee morale in the workplace. Financial stress may be due to outstanding college loans, credit card debt, healthcare, childcare, and eldercare expenses, and mortgage loans in distress. These all cause serious financial hardship and employee stress.

According to a recent insurance industry report, the popularity of financial wellness programs rose to 84% in the past year. This is almost a 20% increase from previous years. Another 14% of employers indicated they plan to implement a financial wellness program or employer assistance program to reduce employee financial stress sometime in the near future.

With so much strain on financial stability, employers and employees look for financial management programs to guide personal money management, among other things. Many employers offer a financial wellness program using big data to assess their value to their business and employees.

Get Started With a Free Debt Analysis

We make it easy on mobile or desktop. FREE with no obligations.

What Are Financial Wellness Programs?

Financial Wellness Programs may include:

- Better 401(k) or 403(b) (TSA Plan) education on savings rates and asset selection

- Discouraging employees from taking loans or withdrawals from retirement funds

- Offering alternatives to payday loan borrowing

- Teaching basic budgeting skills and proper money management

- Advising new managers on how to build long-term wealth

- Helping near-term retirees preserve their retirement savings

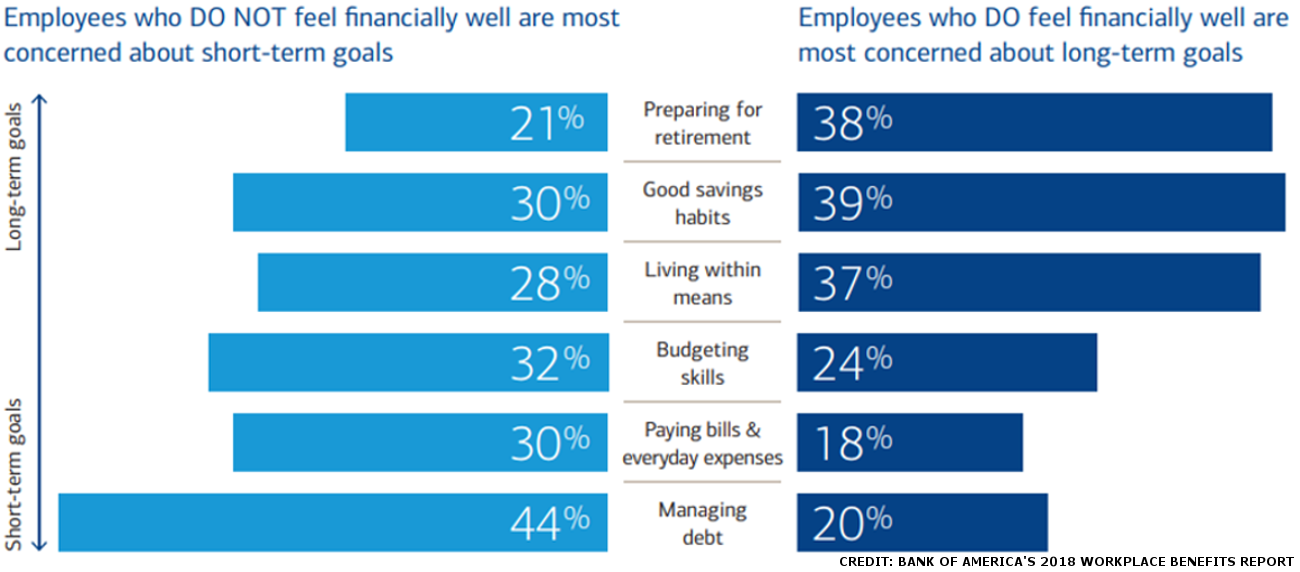

A program that includes goal setting and debt management plans can help employees appreciate the importance of balancing short-term needs against long-term goals. The focus should be on building lifelong money management skills.

Creating A Financial Wellness Program Package –

Employers offer a variety of financial wellness programs. In order for employers to launch a comprehensive program, there are several basics to consider:

- Maintaining focus on existing Human Resources (HR) strategies

- Choosing financial topics to highlight

- Identifying internal challenges before they arise

- Understanding the specific needs of employees

- Coordinating and leveraging employee benefits already offered

- Relying on big data and metrics to project a clear picture of the effectiveness

- Plans for expansion of employer assistance programs

- Consider outsourced resources to aid in the delivery of benefits and programs

Focus on Existing HR Strategies –

If the existing HR strategies have a proven track record of effectiveness, formulate financial wellness programs, so they fit neatly into the overall HR strategies. Employers will avoid reducing the potential loss of important HR initiatives.

Choose Financial Topics to Highlight –

Generally, basic HR strategies lead to awareness of the direction financial topics should take. For example, conducting regular management and departmental assessments, reviewing major compliance issues, and emphasis on building employee skills.

All of these fit neatly into the realm of financial topics like personal financial management, understanding and benefiting from applicable tax laws, and increasing knowledge and skills regarding liability, debt, and credit issues.

Identify Internal Challenges Before They Arise –

With the implementation of new financial wellness programs, it’s important for employers to consider possible internal challenges before they arise. These include actual program management, timely employee access, and overall costs related to internal and external challenges.

Coordinating and Leveraging Employee Benefits Already Offered –

Whenever a new employee program or benefit is offered, it should be related to benefits already offered or be an extension thereof. For example, in workplaces where employees are offered investment programs, an extension of this might include financial wellness programs focused on choosing stock options with the least risk and impact on financial stability.

For workplaces that offer healthcare benefits, important programs related to financial wellness might include those that highlight healthcare insurance costs and prescription savings programs.

Rely on Big Data and Metrics to Project a Clear Picture of Effectiveness –

A major business function is to rely on big data and metrics to optimize the effectiveness of employee assistance programs. The collection of pertinent data and the use of metrics help to drive improvements.

Metrics also help employers focus on employees, overall employee productivity, as well as spikes in employee stress. In addition, big data and metrics also reflect a wide range of resources while providing support for various workplace aspects like finance, employee and management requirements, and employer expectations of program results.

Plans for Expansion of an Employer Assistance Program –

The natural cause and effect of implementing an employer assistance program are more plans to expand on programs that show great interest and are heavily employee populated as a result of program interest.

Expansion planning requires a dedicated effort to research and develop extensions of newly implemented programs similar to those offered in college courses for beginner, intermediate, and advanced levels within each program.

Consider Outsourced Resources –

It may be more cost-effective and timely to consider outsourcing to program experts in financial management, free credit counseling, investment management, and healthcare insurance. These resources offer a broad range of programs that suit most employers’ needs.

Conclusion –

If you’re interested in partnering with Advantage Credit Counseling Service to provide a Financial Wellness Program for your employees or workplace, give us a call at 1-866-699-2227 or send us an email at [email protected]. We’ve been in business since 1968, and we’ve helped many employers and workplaces with their financial wellness needs. We can help you too!