If you’ve been struggling with credit card bills, loan payments, and mounting interest, you’ve probably searched for solutions online. Two common terms that often pop up are Debt Management Programs (DMPs) and Debt Settlement. At first glance, they might sound similar—both aim to reduce your debt burden—but they operate in very different ways and have […]

Continue ReadingCategory: Dealing with Debt

Why A Debt Management Program Is A Smart And Safe Choice For Debt Relief

When you’re feeling overwhelmed by debt, it’s easy to get discouraged or confused by the number of debt relief options available. Debt settlement ads promise to slash what you owe. Debt consolidation loans offer a single payment. Bankruptcy sounds like a clean slate. However, not all solutions are created equal—some can leave lasting damage to […]

Continue ReadingHow Consumers Can Use AI To Save Money And Get Out Of Debt

Artificial Intelligence (AI) is no longer just a buzzword for techies and large corporations. It’s rapidly becoming part of everyday life—from helping you write emails to powering your smart home devices. However, did you know AI can also help you take control of your personal finances? If you’re looking for ways to save money, manage […]

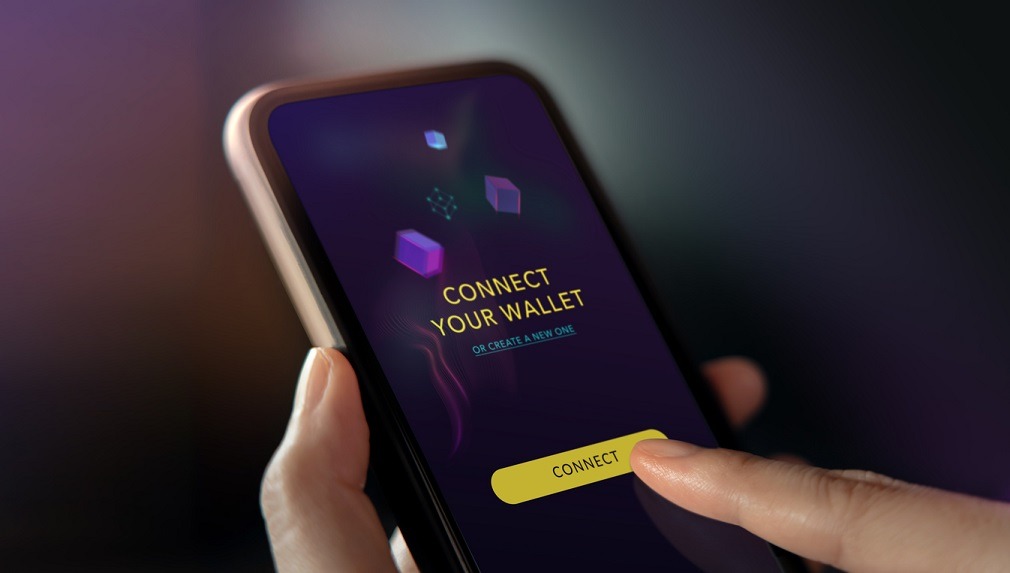

Continue ReadingDigital Wallets & The Psychology Of Spending In A Cashless Society

Gone are the days when cash was king. Today, a growing number of Americans are leaving their wallets at home and bringing their smartphones instead. Thanks to digital wallets and tap-to-pay technology, making a purchase is often as simple as a wave of the wrist. This shift to a cashless, frictionless payment world has undeniable benefits: […]

Continue ReadingDebt Management Programs Could Be Your Path To Financial Freedom

Managing debt can feel overwhelming, especially when it comes to unsecured debt like credit cards and retail store accounts. With rising inflation and the cost of living continuously increasing, many people are finding themselves buried under mounting bills. If you’re struggling to keep up with payments, a Debt Management Program (DMP) offered by a non-profit […]

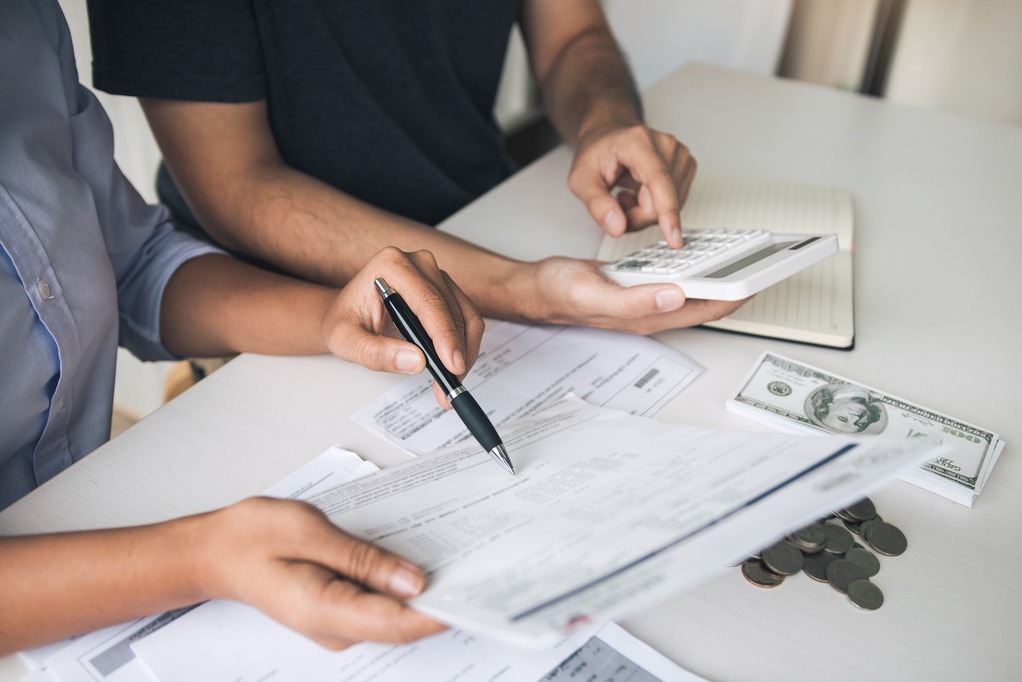

Continue ReadingHow To Start Digging Your Way Out Of Debt

Debt can feel like a never-ending weight, pressing down on every aspect of your life. When you’re in deep, it might seem like the road to financial freedom is out of reach. But no matter how overwhelmed you feel, there’s always a way forward. Today, let’s take a fresh approach by focusing on the first […]

Continue ReadingHow To Build An Emergency Fund While Paying Off Debt

Managing finances can feel like a juggling act, especially when trying to pay off debt while also saving for an emergency fund. While it might seem counterintuitive to set money aside when every extra dollar could go toward debt repayment, having an emergency fund is essential for financial stability. Without one, unexpected expenses—like car repairs, […]

Continue ReadingWhat Happens To Debt When A Loved One Dies?

In most cases, family members are not directly responsible for paying off a deceased relative’s debts. Debt typically does not transfer to relatives unless they were co-signers, joint account holders, or otherwise legally obligated. Instead, debts are usually paid from the deceased person’s estate. Dealing with the loss of a loved one is already a […]

Continue ReadingHow Many Credit Cards Should You Really Have Open At One Time?

Credit cards are a staple of modern financial life, offering convenience, rewards, and the opportunity to build credit. But how many is too many? The answer isn’t the same for everyone. Understanding the balance between maintaining healthy credit use, and avoiding potential debt pitfalls is essential. This blog will explore the average number of credit […]

Continue ReadingThe Hidden Costs of Debt: How Interest Rates and Fees Can Add Up

Debt can be a useful tool for achieving your financial goals, but it comes with hidden costs that can quickly spiral out of control. Understanding these costs—such as interest rates, late fees, and other charges—can help you manage your debt more effectively and save money in the long run. In this blog post, we’ll explore […]

Continue Reading