According to CBS News, nearly half of Americans have more credit card debt then they do savings, the lowest percentage since the figure was first tracked in 2011. With each year, more and more Americans find themselves facing an uphill battle against credit card debt. Turning to the aid of credit counseling services may not […]

Continue ReadingAuthor: Lauralynn

How to Build a $1,000 Emergency Fund in 10 Months

Do you have $1,000 set aside for emergencies? If you already do, you could probably use another $1,000 in that emergency fund. Experts recommend keeping, at least, three months expenses in a reliable, liquid account – though even an extra $1,000 can be a life-saver. But finding $1,000 to save isn’t always easy. That’s why we’ve […]

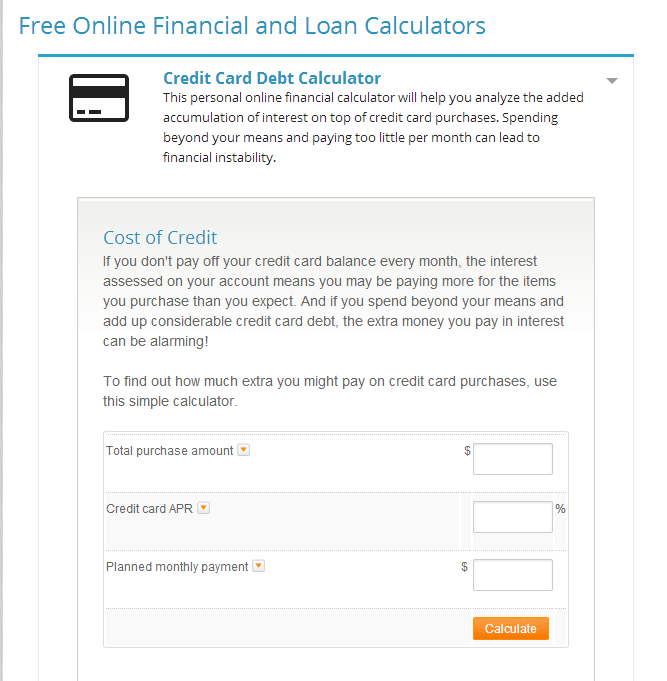

Continue ReadingCredit Card Debt Calculator and How to Pay Off Debt

You can always count on interest accumulating if you carry a balance every month on your credit cards. Sure, you may still have a month or two of “free interest” left on that credit card you signed up for, but when that promotion ends, what happens then? You get hit with some charges and fees […]

Continue ReadingPaying Off Student Loans

Student loan debt has surpassed credit card debt in 2014. Student debt has now crossed the $1 Trillion mark and will probably continue to rise quickly unless the government understands its implications on the US economic growth and takes action to mitigate the problem. The graduating class of 2014 is the most indebted, with roughly […]

Continue ReadingChoosing a Debt and Credit Counseling Service

Have the bills been piling up, and you don’t know where to turn? You need a credit or debt counselor to steer you in the right direction. Most credit counselors with a good reputation are non-profit organizations and offer their services through local branches, online and over the phone, says the Federal Trade Commission. What to […]

Continue ReadingWhat Is A Debt Management Plan?

We get this question a lot from individuals who are battling debt problems. So we figured that we’d give everyone a fairly in-depth and detailed explanation of what a Debt Management Plan (DMP) really is. The Wikipedia definition is very broad and general, but it states: “A debt management plan is a formal agreement between a debtor […]

Continue ReadingSlideshow: 5 Options for Getting Out of Debt

Getting out of debt, especially credit card debt can be a very difficult task and the stress that goes along with it can be even more taxing. Credit card debt can lead to issues with relationships and family, and has even been known to cause depression. The average number of filings for bankruptcy by businesses […]

Continue ReadingChapter 13 Bankruptcy vs. Chapter 7 Bankruptcy

The majority of bankruptcies filed within the United States are either Chapter 13 or Chapter 7 bankruptcy cases. Do you know the difference between the two of them? It’s very important to know the difference if you’ve ever considered filing for bankruptcy. To find out whether a Chapter 13 or Chapter 7 bankruptcy would be […]

Continue ReadingCredit Counseling – What Questions to Ask

Credit Counseling can be the answer to many of your financial troubles. Advantage CCS offers stress-free credit counseling to people in need of professional advice, all of which is offered by an experienced and certified credit counseling agency. By analyzing your current financial situation, a certified credit counselor will be able to recommend a plan […]

Continue ReadingBest Budgeting Apps

Budgeting used to be boring and time consuming, but with today’s technology it does not have to be like that. Almost everyone has some sort of a smart phone nowadays, and they can be used to help you budget better, faster, and more often. There’s a plethora of free and low-cost budgeting and financial apps […]

Continue Reading