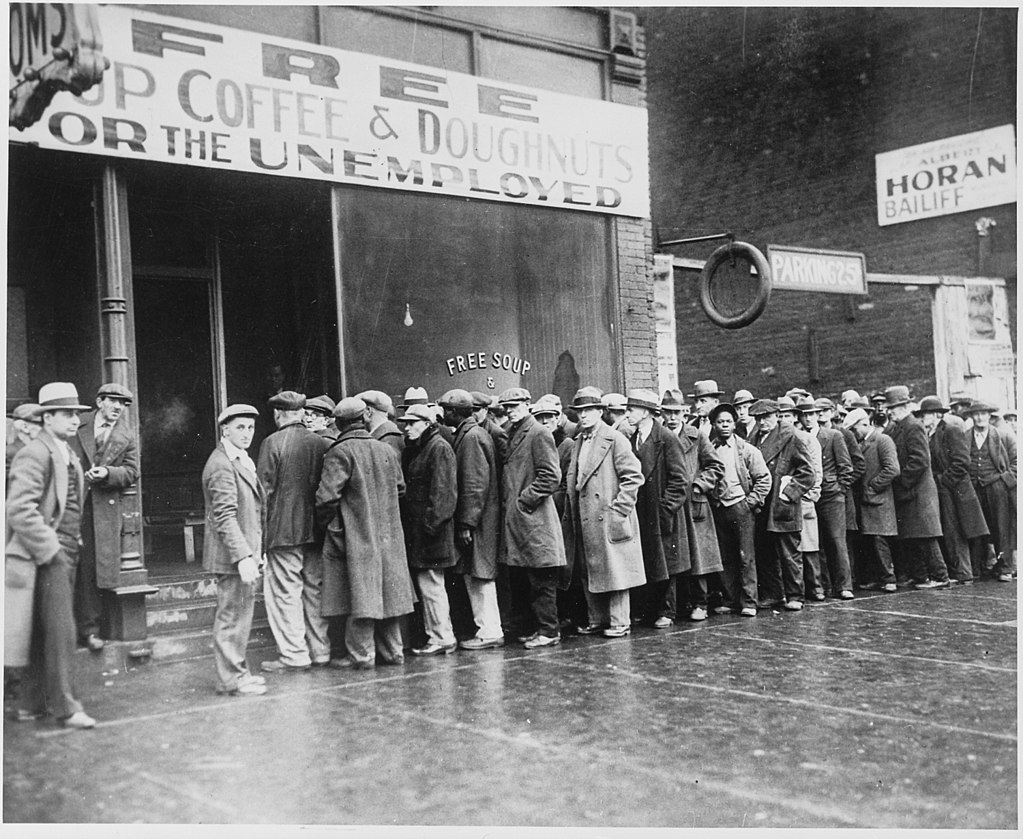

“Use it up, wear it out, make it do, or do without.” ― Boyd K. Packer The Great Depression era was a tragic period in history because of the devastating effects that it had on the economy, stock market, and banks. But what most people who lived through it remember the most about it is the shock […]

Continue ReadingAuthor: Lauralynn

The Best Way To Handle Payday Loan Debt

More than 12 million Americans take out payday loans every year, and a significant number of these advances go into default. It is estimated that borrowers pay more than nine billion dollars in loan fees and are more susceptible to suffering the snowball effect when accepting the terms of a short-term loan such as a […]

Continue ReadingChildren’s Clothing Options That Are Budget Friendly

When it comes to buying clothes for children, this is an area that can become an expensive endeavor. It is also an area of a parent’s financial responsibilities that are affected by the age of the child for which they are buying these clothes. Obviously, the threads they buy for their teenager will tend to […]

Continue ReadingHow to Save Money for a Rainy Day

Saving money for a rainy day may seem impossible at times. Everything around us seems to be increasing in price, yet your pay probably remains stagnant. Everyone should attempt to put away money for an emergency, even if it’s only a little at a time. If you don’t already have one, then you probably often […]

Continue ReadingWorld Backup Day: 4 Ways To Protect Your Devices Against Hacks

March 31st is World Backup Day, the brainchild of a couple users on Reddit who, after losing their own information, wanted to raise awareness about the many ways data is playing an increasingly important role in our lives, and how critical it’s become to regularly backup and protect your digital information. “It’s not only a […]

Continue ReadingCredit Scores and How They Came to Be

Prior to the creation of credit scores, financial institutions and lenders would often develop their own creditworthiness score to assess the risk of lending to that particular person. This “score” would vary significantly from one lender to the next. The major issue with this innovative method was that it was based solely on the lender’s […]

Continue ReadingDebt Management for College Students: How To Deal With The Debt

When you are a student in college the last thing on your mind is saving money, debt management, the wise use of credit, and pretty much anything having to do with budgeting or finances. But college can actually create a financial future full of debt and doubt if you aren’t careful. You’ll receive many credit […]

Continue ReadingThe Truth About Debt And Credit Counseling

How Did I End Up Here – If you were to write a story or song about your financial status would it leave people reaching for a box of tissues? If so, you’re not alone. Many people across America have found themselves struggling with credit card debt. Part of the problem is the ease at […]

Continue ReadingTax Season Fraud and Identity Theft

Founded by the Federal Trade Commission, Tax Identity Theft Awareness Week sets aside 5 days to encourage and educate taxpayers to protect their tax and personal identification information. As reports show, there was a staggering 400% increase in tax-related phishing attacks during the 2016 filing season. Therefore, it’s important that taxpayers are aware of the […]

Continue ReadingHow To Save Money On Valentine’s Day

Hey lovebirds, are you ready for Valentine’s Day? It’s right around the corner! This special holiday is all about love and showing your significant other how much you care. Consumer spending can usually get a little out of control on this holiday. Remember, you don’t have to break the bank to make the day special. […]

Continue Reading