The Online Budget Advisor tool sets itself apart from the competition by putting over 54 years of expert financial experience behind our system. Our tool is easy to understand, super-efficient, and extremely thorough. The system asks the very same questions that our professional budgeting experts and certified credit counselors ask during their face-to-face or telephone counseling sessions. […]

Continue ReadingAuthor: Lauralynn

How Is Having No Credit History The Same As Having Bad Credit?

It can be tough to get approved for a loan or credit card if you don’t have any credit history. Many people think that this is the same as having bad credit, but this isn’t always the case. Having no credit history can be worse than having bad credit. Lenders see you as a riskier […]

Continue ReadingLearn How Debt Management Programs Are A Type Of Debt Consolidation

When people feel overwhelmed by their level of debt, they may seek relief through a debt management program. This type of debt consolidation can help people get back on track financially by working with a credit counseling agency. This blog post will discuss debt management programs and how they work. It will also provide information […]

Continue Reading10 Steps To Take If You’re A Victim Of Unemployment Insurance Fraud

If you are a victim of unemployment insurance fraud, it’s essential to take the appropriate steps to protect yourself and your finances. Unfortunately, this type of crime is on the rise, and it can be difficult to get your money back if you fall victim. In this blog post, we will discuss ten steps that […]

Continue ReadingHow A Minimalistic Lifestyle Can Improve Your Relationship With Money

When many people think about minimalism, they associate it with not having a lot of things. However, it can go a lot deeper than that and can even affect how you spend money. Many times, a minimalistic lifestyle can improve your relationship with money in the following ways. You Can Tackle Debt Better – A […]

Continue ReadingPersonal Financial Planning For A Loved One With Dementia

It is estimated that over 5 million people are living with some form of dementia in the United States alone. As the population continues to increase, these numbers are expected to rise. There are various types of dementia, such as Alzheimer’s Disease, Vascular Dementia, Frontotemporal Dementia, and Lewy Body Dementia. When a loved one has […]

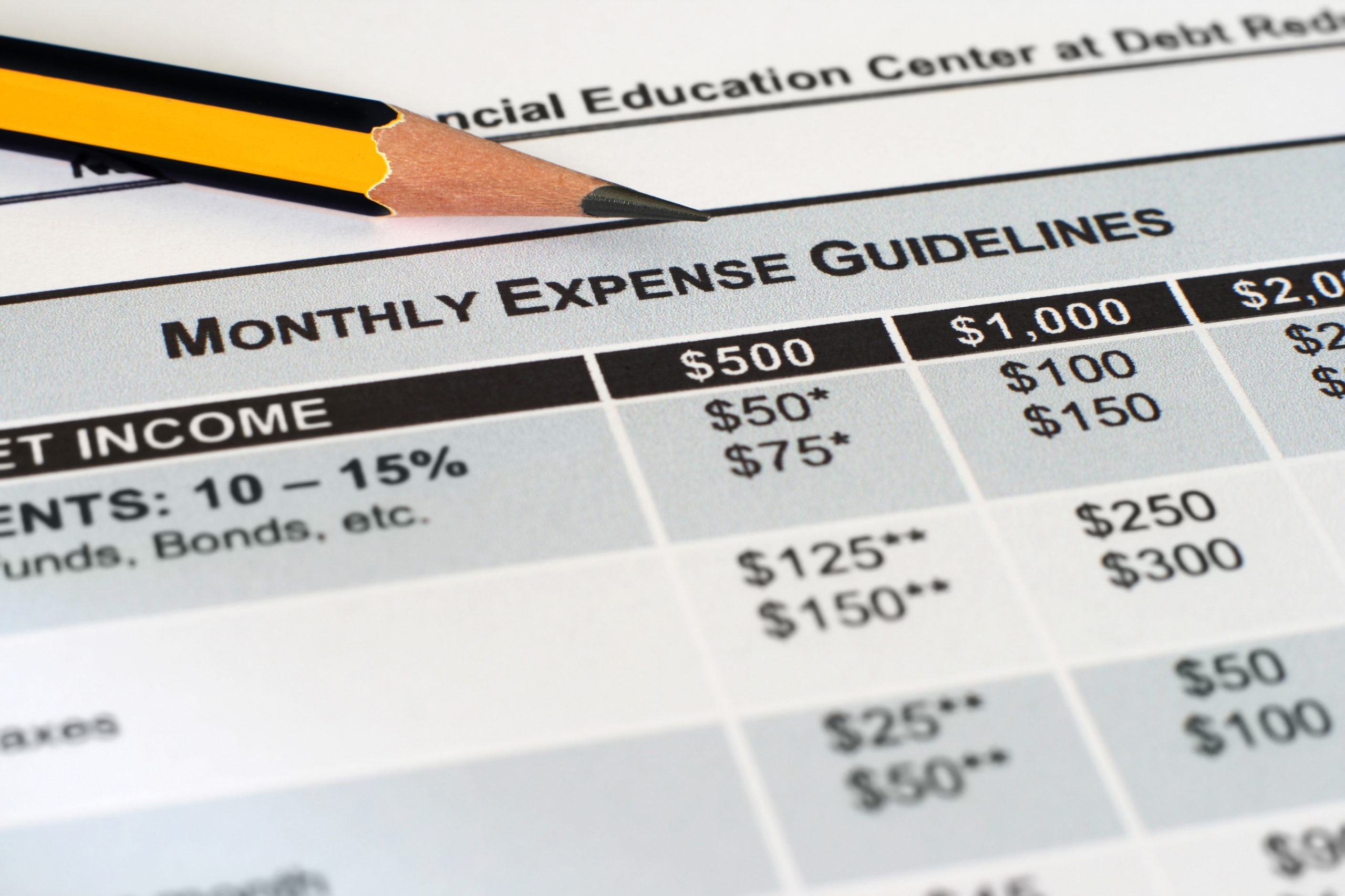

Continue ReadingFind Out How To Reduce Your Monthly Expenses In 2022

As the year wraps up (pun intended), we can look ahead to next year and wonder what our finances might look like in 2022. It’s no secret that inflation is taking off right now, and prices are climbing higher and higher for our everyday needs. So, how does a person reduce their monthly expenses when […]

Continue ReadingHow Much Should You Contribute To Your 401(k) Plan In 2022

The amount of money that you put into your retirement fund now will have a big impact on what you can afford to live on when you retire. How much should you contribute to your 401 (k) in 2022? It is a question that many people are asking. The answer is different for every person […]

Continue ReadingLearn How To Set Financial Goals For 2022 And Reach Them

Financial goals are an essential part of anyone’s ongoing financial plans, but they can be challenging to set. When one sets financial targets, it’s important to make sure that they are S.M.A.R.T. Goals. We’ll talk more about this later on. This blog post will cover some steps to help you establish your financial goals and […]

Continue ReadingCap Those Gas Prices: How To Save Money At The Gas Pump

With the current trends of geopolitical unrest and increasing gas prices, it’s important to take control of your wallet. Oil prices are no one’s friend, and it seems that the only thing that fluctuates more than the price at the pump is how much we’re paying for a gallon. It’s essential to learn how to […]

Continue Reading